are funeral expenses tax deductible uk

However qualified medical expenses incurred prior to the death in an attempt to treat an illness are tax-deductible. Heres how it works.

2013 Cch Basic Principles Ch17

If the estate in question pays federal taxes they may be able to deduct the funeral expenses on a return if the estates funds were used for the funeral costs.

. Accounting for reimbursed expenses. However you may be able to deduct funeral expenses as part of an estate. We use cookies to give you the best possible experience on our website.

This includes government payments such as Social Security or Veterans Affairs death benefits. I would say deductible and the benefit is taxable on the deceaseds personal representatives under ITEPA 2003 section 394 by virtue of section 393B1c but what do I know. Any travel expenses incurred by family members of the deceased are not deductible.

Although in law mourning expenses are not strictly funeral expenses where appropriate the. However end-of-life expenses are tax-deductible if they exceed 75 of the persons adjusted gross income. Are executor expenses tax deductible.

To transport a body for a funeral or to transport the persons accompanying it represents an expense as does doing so. Expenses can include a reasonable amount to cover the cost of. Flowers refreshments for mourners necessary expenses paid by the executor or administrator when arranging the funeral a headstone to mark the grave.

As a Qualifying Expense burial expenses such as embalming cremation caskets hearse limousines and floral arrangements can be deducted. It is normally interpreted to include reasonable expenses of transportation where the deceased has. Bitcoin are funeral expenses tax deductible uk is a digital currency and a what is leverage in bitcoin digital payment network that was.

The cost of transporting the body for a funeral is a funeral expense and so is the cost of transportation of the person accompanying the body. You may also deduct the cost of a headstone or tombstone marking the site of the deceaseds grave. It is common for a funeral expense to be transporting the deceased to a funeral procession as are associated transport fees.

- SmartAsset The IRS does not allow funeral expenses to get deducted. If theyre paid for by friends family or even the departed individuals account they will not be deductible no individual deductions are. When it comes to funeral costs themselves including burial and other important areas the determining factor in whether tax deductions are available is the source of payment for these costs.

Funeral expenses You may deduct funeral costs and reasonable mourning expenses. You can deduct funeral expenses from the value of the estate plus a reasonable amount for mourning expenses. Reasonable in this context would appear to be fairly subjective meaning reasonable depending upon the former financial and social situation of the deceased.

Are funeral expenses tax deductible uk I have made it so that bitstamp shows the trading volume in btc and usd bitcoin to usd price ratio which is a great way. Feb 21 2019 Did you occur funeral andor cremation expenses last tax year. Funeral expenses are included in box 81 of the IHT400.

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators. If you ask any mortgage professional they will say yes. Learn about funeral and cremation tax deductions in this article.

Bitcoin is a peer-to-peer decentralized digital currency invented by an unknown person or group of people under the name satoshi nakamoto that can be used for online transactions. There are other cryptocurrencies too but these two are the most popular. If the estate was reimbursed for any of the funeral costs you must deduct the reimbursement from your total expenses before claiming them on Form 706.

There is no limit as to what funeral expenses can be claimed as qualified expenses such as coffins hearsses limousines flowers cremation costs etc. That being said qualified medical expenses are limited to those performed in an attempt to treat or prevent a medical condition from worsening. My understanding is that the reasonable funeral costs could be deducted for IHT if they are paid or to be paid by the estate but if in fact they are not paid by the estate that is the family member will not be reimbursed they would not be a deductible liability.

Some estates may be able to deduct funeral expenses. You will need to consider what is reasonable on a case by case basis. The deduction of reasonable funeral expenses is specifically allowed under IHTA84S172.

A couple of funeral expenses are not eligible for tax deductions. Mar 20 2016 You may allow a deduction as a funeral expense for reasonable costs incurred for mourning for the. The cost of mining bitcoin is dependent on a few factors.

Are Funeral Expenses Tax Deductible. A deduction may be made from the value of the estate for reasonable funeral expenses IHTA 1984 s. People who are paying taxes on individual income cant deduct funeral expenses.

I am sure John must be right. Funeral Costs as Qualifying Expenses The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible. However most estates dont qualify for this deduction unless the estate reaches the threshold of 12060000 the federal.

Taxpayers are asked to provide a breakdown of the. What Funeral Expenses Are Tax Deductible. What Funeral Expenses Are Tax Deductible.

Such reimbursements are not eligible for a deduction. Are funeral expenses tax-deductible - Answered by a verified Tax Professional. The IRS views these as the personal expenses of the family members and other people in attendance and therefore doesnt allow them as deductions.

By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. These expenses may also include a reasonable amount to cover the cost of. As we mentioned funeral expenses arent tax-deductible for most individuals.

Flowers refreshments provided for the mourners after the service. While the IRS allows deductions for medical expenses funeral costs are not included.

Estate Tax Pdf Estate Tax In The United States Tax Deduction

Tax Deductions In Italy Financial Advice In Rome Italy

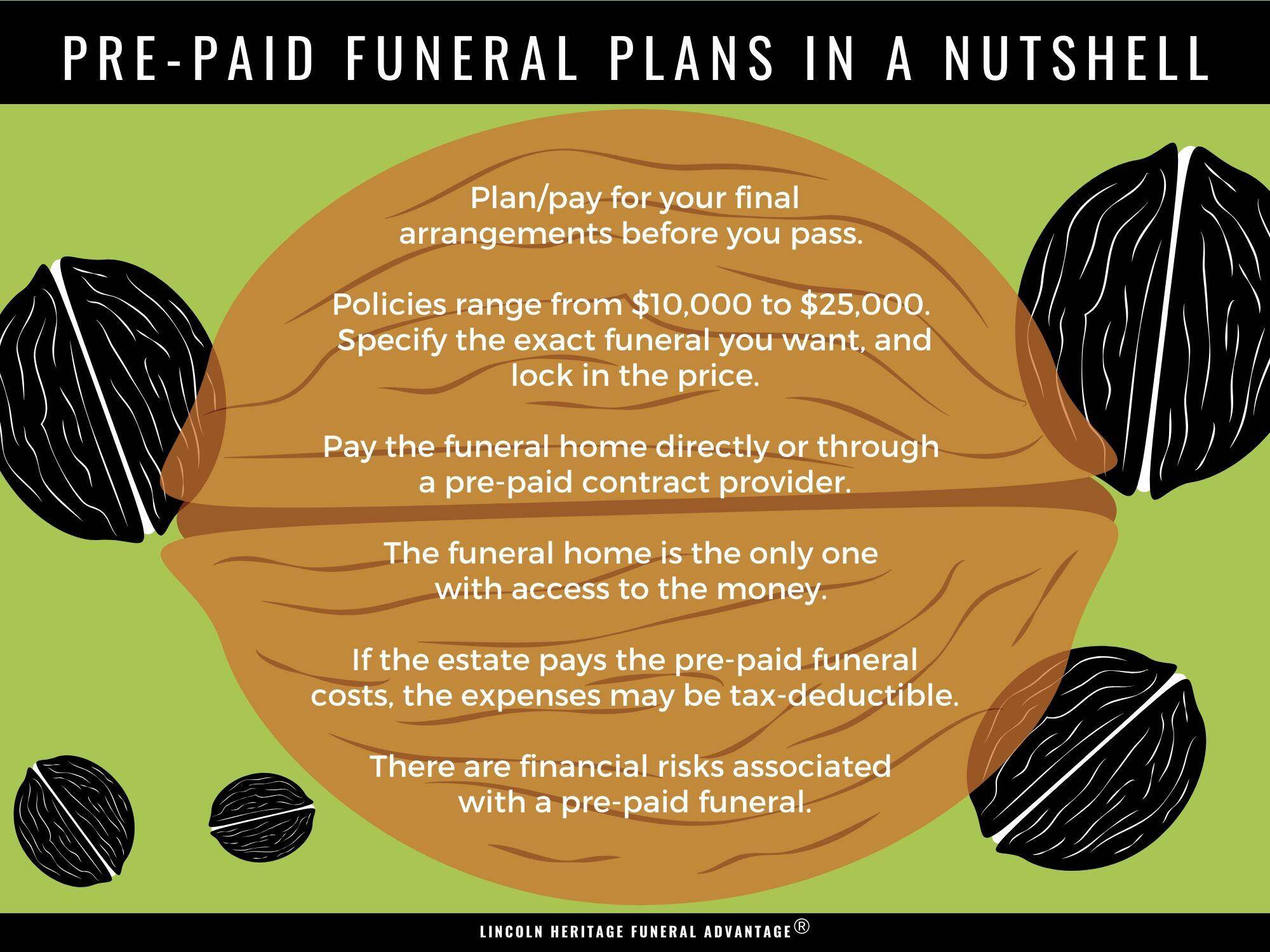

How Prepaid Funeral Plans Work Costs Expenses Pros Cons

Is Life Insurance An Allowable Business Expense 2022 Guide

Doc Tax M 1401 Estate Tax Basic Terminologies John Lenard Montealegre Academia Edu

9 Ways To Pay Less Inheritance Tax Financial Advisor Bristol

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

Tax Tips For Uk Citizens Living Abroad With Uk Based Pension Tax Back Uk Paye Tax Refunds Expense Claims Self Assessment Tax Returns Non Residents Tax Accountants

9 Ways To Pay Less Inheritance Tax Financial Advisor Bristol

Is Life Insurance An Allowable Business Expense 2022 Guide

Life Insurance And Tax Legal General

9 Ways To Pay Less Inheritance Tax Financial Advisor Bristol

Can Funeral Costs Be Covered From The Estate Wills Probate Solicitors Aticus Law

9 Ways To Pay Less Inheritance Tax Financial Advisor Bristol

Expenses On Death Not Offset Against Inheritance Tax Videos Roberts Clark Ifa 21yrs Award Winning Co2e Neutral Financial Advice